Tentative Approval for Generics: Common Reasons for Delays

When a generic drug gets tentative approval from the FDA, it doesn’t mean it’s ready to hit pharmacy shelves. It means the agency has reviewed the application and found it scientifically sound - but something is still blocking it from being sold. That something is often not a flaw in the drug itself, but a legal, regulatory, or economic roadblock. Between 2010 and 2023, over 2,500 generic drugs received tentative approval, yet many never reached patients. Why? Here’s what’s really holding them back.

Patent Battles Are the Biggest Blocker

The most common reason a tentatively approved generic never launches? Patent lawsuits. When a brand-name drug company files a patent infringement claim against a generic maker, the FDA is legally required to delay final approval for up to 30 months. This is called the "30-month stay." It doesn’t matter if the generic is safe, effective, and meets every technical requirement. If the patent fight is still going, the FDA can’t give final approval.Between 2010 and 2016, 68% of tentatively approved generics were stuck in this legal limbo. Some brand companies file these lawsuits even when the patent is weak or questionable. Others use "citizen petitions" - formal requests to the FDA arguing that the generic isn’t equivalent - to delay approval. Between 2013 and 2015, the FDA received 67 such petitions from brand manufacturers. Only three were granted. Most were scientifically unsupported, but they still bought time.

Then there’s "product hopping" - when a brand company makes a tiny change to the drug, like switching from a pill to a capsule, and gets a new patent. This resets the clock on generic competition. A 2018 FTC study found this tactic affected 17% of the top-selling drugs. And "pay-for-delay" deals? That’s when a brand company pays a generic maker to hold off on launching. Between 2009 and 2014, these deals delayed 987 generic entries.

Manufacturing Problems Keep Coming Up

Even if the patent clears, the drug still needs to be made right. The FDA inspects manufacturing facilities before approving a generic. And too often, those inspections turn up problems.In 2022, 41% of complete response letters (CRLs) - the FDA’s official "you didn’t pass" notices - cited facility issues. The top three? Inadequate quality control systems (63% of facility-related CRLs), poor environmental monitoring (29%), and unqualified equipment (24%). These aren’t minor mistakes. They’re systemic failures in how the drug is made. A single dirty room or faulty calibration can shut down an entire production line.

Complex drugs are even harder. Inhalers, creams, injectables - they require more precise manufacturing. A 2022 FDA report found that complex generics went through 2.3 times more review cycles than simple pills. One company spent over two years fixing its manufacturing process after its first tentative approval. By then, the patent had expired, but the delay cost them market share.

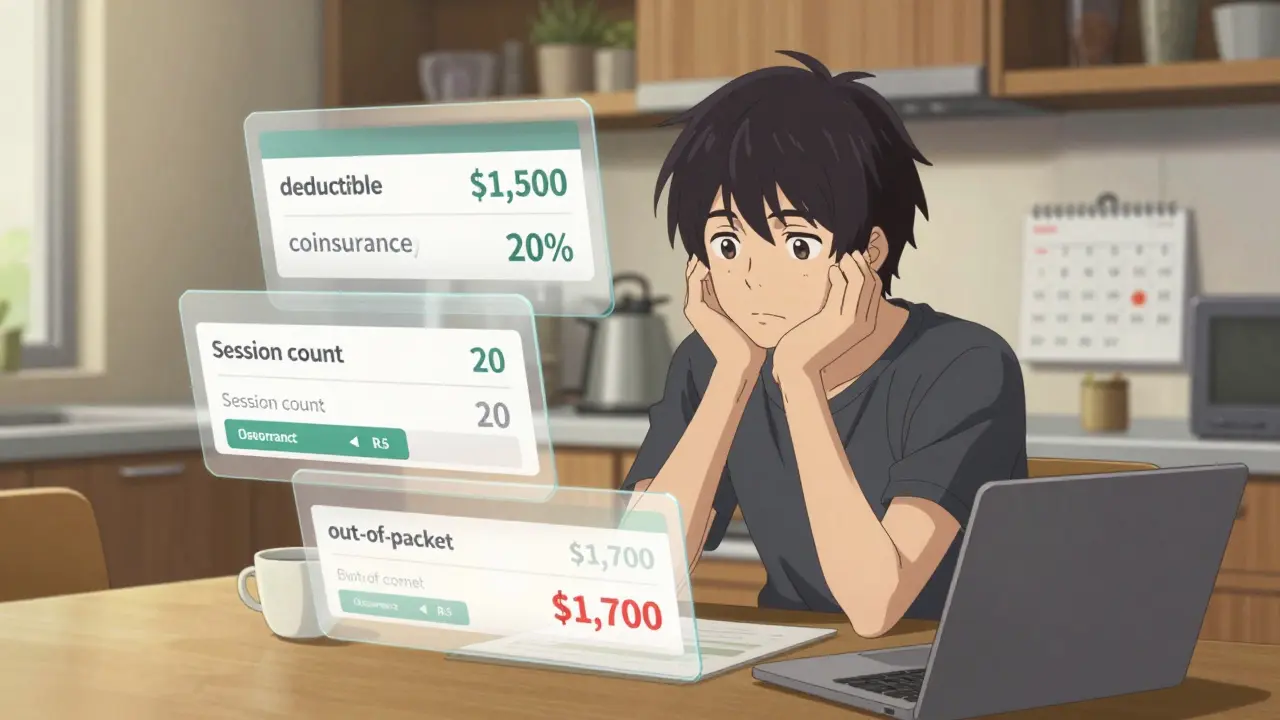

Applications Are Often Incomplete - and Slow to Fix

Many generic applicants submit incomplete applications. Not because they’re careless, but because the requirements are complex. The FDA’s 2021 report said 29% of initial submissions were missing key data - stability tests, bioequivalence results, or labeling details.When the FDA sends back a deficiency letter, the clock starts ticking. Applicants have six months to respond. But in 2022, the average time to reply was 9.2 months. That’s a three-month delay right there. Some companies wait until the last minute. Others don’t have the resources to fix the issues fast. And if they miss the deadline, the application gets pushed to the back of the line.

Stability data is especially tricky. It shows how the drug holds up over time under different temperatures and humidity. If the data doesn’t cover the full shelf life, the FDA won’t approve it. In 2022, 43% of all deficiencies were related to stability. Container closure systems - the vials, caps, and packaging - were another major issue. If the packaging lets in moisture or air, the drug can degrade. That’s not a small detail. It’s a safety risk.

Market Economics Don’t Always Add Up

Even when a generic clears every hurdle, the company might decide not to launch it. Why? Because it doesn’t make financial sense.Drugpatentwatch.com found that 30% of tentatively approved generics never hit the market. For drugs with annual U.S. sales under $50 million, that number jumps to 47%. If the potential profit is too low, manufacturers won’t invest in scaling up production. They’d rather focus on drugs that sell in the billions.

Even when generics do launch, prices don’t always drop fast. A 2019 JAMA study found that if only one generic competitor enters the market, prices stay at 80% of the brand’s price for two full years. That discourages other companies from entering. So you get one generic - and then nothing. The brand keeps its market share, and patients pay more than they should.

Complex Drugs Are Still a Nightmare

Some drugs are just harder to copy. Topical creams, inhalers, and complex injectables require advanced technology and deep expertise. The FDA’s 2019 report showed that these complex generics take 14 months longer to approve than simple pills. In 2020, Jessica Lee from the Brookings Institution pointed out that complex products average 3.7 review cycles - compared to 2.9 for oral solids.The FDA tried to fix this with a 2020 draft guidance on complex generics. But only 12% of applicants met the 10-month target. Why? Because the science is still evolving. Testing methods aren’t standardized. Manufacturers don’t always know what the FDA expects. So they guess - and get rejected.

What’s Being Done to Fix It?

The FDA knows the system is broken. That’s why they created the Competitive Generic Therapy (CGT) pathway in 2017. It gives priority review to drugs with little or no generic competition. Of the drugs that got CGT status, 78% received tentative approval in under 8 months - compared to the usual 18.The agency also launched a 2022 initiative to fast-track 102 high-priority tentatively approved drugs. Of those, 67% got final approval within a year - compared to just 34% for non-priority cases.

But progress is slow. The average time from tentative approval to market launch was still 16.5 months in 2022 - barely better than 18.3 months in 2016. First-cycle approval rates? Only 28% in 2022. The goal under GDUFA III is 70% by 2027. That’s ambitious.

Legislation like the CREATES Act (2019) and the Affordable Drug Manufacturing Act (2023) are trying to fix patent abuses and improve access to reference samples. But brand companies still find loopholes. And the FDA still doesn’t have enough staff to handle the volume.

As of 2023, 517 brand drugs still had no generic version - and 312 of them had tentative approvals stuck in legal or regulatory limbo. The system is designed to get generics to market faster. But in practice, it’s still full of holes.

What does tentative approval actually mean?

Tentative approval means the FDA has determined the generic drug meets all scientific and quality standards for safety, effectiveness, and manufacturing. But it cannot be sold yet because of patent protections or regulatory exclusivities on the brand-name version. It’s a "ready when the coast is clear" status.

Can a generic drug be sold after tentative approval?

No. Tentative approval is not final approval. The drug cannot be legally marketed until the patent or exclusivity period on the brand drug expires, and the FDA grants final approval. Even then, the manufacturer must still choose to launch it.

Why do some tentatively approved generics never launch?

Many never launch because the market isn’t profitable enough. If the brand drug sells for less than $50 million a year, manufacturers often decide the cost of scaling production isn’t worth it. Others delay launch waiting for competitors to enter, hoping to avoid price wars. Patent litigation can also drag on so long that the opportunity passes.

How long does it take from tentative approval to market launch?

On average, it takes 16.5 months from tentative approval to market launch. But this can stretch to over two years if patent litigation is involved. Some never launch at all.

Are complex generics harder to approve?

Yes. Complex generics - like inhalers, creams, or injectables - require more testing, more precise manufacturing, and more FDA scrutiny. They go through 2.3 times more review cycles than simple pills and take an average of 14 months longer to approve.

Comments

Gary Mitts

February 3, 2026 AT 04:02So let me get this straight - we spend billions on drugs, but the system is designed to keep generics off shelves so pharma can keep pricing gouging?

Wow. Just wow.

Chinmoy Kumar

February 4, 2026 AT 02:22this is so frustrating but also kinda make sense in a twisted way... i mean if you think about it, patents were meant to protect innovation but now theyre just legal shields for profit. hope things change soon

George Firican

February 4, 2026 AT 17:58You know what’s truly tragic here? It’s not the science or the regulation - it’s the human cost. People are skipping doses, rationing pills, or just going without because a corporation decided it’s more profitable to delay a $0.20 tablet than to let competition do its job. We’ve turned healthcare into a chess game where patients are the pawns. And the worst part? The FDA isn’t even the villain here - they’re the janitor cleaning up after a party where the guests stole the silverware and left the mess behind.

clarissa sulio

February 4, 2026 AT 18:33The fact that 30% of tentatively approved generics never launch because the market is too small is criminal. We’re not talking about luxury meds here - we’re talking about insulin, blood pressure pills, antibiotics. If it saves lives, it should be profitable.

Sandeep Kumar

February 5, 2026 AT 14:23US pharma thinks they own the world but the real problem is the indian manufacturers who cant even get their packaging right

how can you trust a pill from a factory that cant seal a vial properly

Anthony Massirman

February 6, 2026 AT 22:15The FDA's backlog is insane. 28% first-cycle approval? That’s like applying for a driver’s license and getting told to come back in 18 months because the DMV lost your form.

Vatsal Srivastava

February 8, 2026 AT 20:01you think this is bad wait till you hear about how the eu handles generics

Akhona Myeki

February 10, 2026 AT 04:04India and China think they can just flood the market with cheap drugs but they ignore quality control. The FDA isn’t being difficult - they’re protecting lives. If you want cheap medicine, build a lab that meets standards not complain about bureaucracy.

Matt W

February 10, 2026 AT 04:53I’ve seen this firsthand - my mom waited 18 months for her generic blood pressure med. She had to pay $200 a month for the brand because the generic was "tentatively approved" but stuck in legal limbo.

Meanwhile, the CEO of the brand company bought a private island. Just sayin’.

Solomon Ahonsi

February 11, 2026 AT 09:53so basically the system is rigged and we all just gotta suffer until someone with money gets rich off it

Bridget Molokomme

February 12, 2026 AT 04:49Oh so now it’s the FDA’s fault? Let me guess - you’d rather have untested generics in your medicine cabinet? Because that’s what happens when you remove oversight. I’m all for lowering prices but not at the cost of someone’s liver.

Brett MacDonald

February 12, 2026 AT 22:11philosophically speaking... if a drug is approved but cant be sold... does it even exist in the market?

also who the hell wrote the gdufa iii goals anyway